Change Your Money Mindset: Top Budgeting Apps for Financial Freedom in 2025

Introduction

Financial freedom starts with a powerful mindset. At Mindset Reprogramming, we know that changing your money mindset can transform your financial life. By combining positive thinking with practical tools like budgeting apps, you can overcome financial stress and build lasting wealth. In this guide, we’ll explore how to shift your money mindset and review the top 5 budgeting apps to achieve financial freedom in 2025. Ready to take control? Let’s dive in!

Why Your Money Mindset Matters

Your beliefs about money shape your financial decisions. A scarcity mindset leads to overspending, while an abundance mindset encourages saving and investing. According to The Power of Positivity, a positive money mindset reduces stress and boosts goal achievement. Pairing this mindset with budgeting apps ensures you stay on track to financial freedom—whether paying off debt, saving for a home, or building a side hustle.

3 Steps to Change Your Money Mindset

Before exploring budgeting apps, let’s reprogram your subconscious for wealth with these actionable steps:

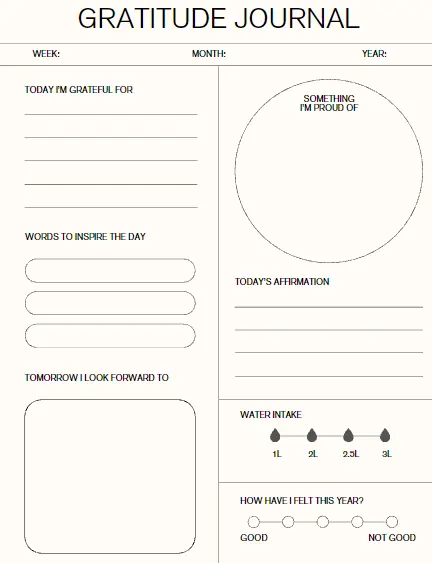

1. Practice Gratitude for Wealth

- Why: Gratitude shifts focus from lack to abundance, per Positive Psychology Training.

- How: Each morning, write down 3 financial blessings (e.g., a steady income, no overdue bills). This builds a positive outlook.

- Action: Start a gratitude journal. Link to our Overcome Negative Thinking Guide for more tips.

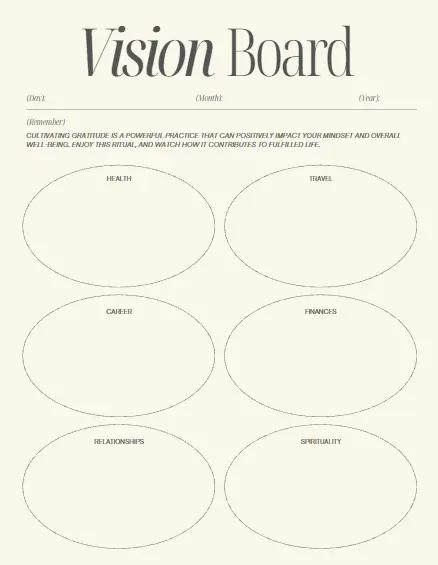

2. Visualize Financial Freedom

- Why: Visualization aligns your subconscious with goals, as noted by Vocal Media.

- How: Spend 5 minutes daily imagining your debt-free life or dream vacation funded by savings. Picture details like your bank balance.

- Action: Create a vision board for financial goals. Check our Creating a Vision Board Guide.

3. Learn from Financial Wins and Losses

- Why: Viewing setbacks as lessons fosters resilience, per Zen Habits.

- How: Reflect on a past financial mistake (e.g., impulse purchase). Ask, “What did I learn?” Then celebrate a win (e.g., sticking to a budget).

- Action: List 1 win and 1 lesson this week. Read our Handling Life’s Challenges Post.

Top 5 Budgeting Apps for Financial Freedom in 2025

Budgeting apps simplify money management, aligning your spending with your financial freedom goals. Here are our top picks, each with mindset tips to maximize their impact:

- YNAB (You Need A Budget)

- Features: Goal tracking, debt payoff tools, real-time syncing.

- Why It Wins: Encourages proactive budgeting, aligning with a growth mindset.

- Mindset Tip: Set a monthly “abundance goal” (e.g., save $100) to stay motivated.

- Cost: $14.99/month or $99/year (affiliate link: YNAB Signup).

- Best For: Beginners seeking financial clarity.

- Mint

- Features: Free budget tracking, credit score monitoring, bill reminders.

- Why It Wins: User-friendly interface fosters confidence in money management.

- Mindset Tip: Celebrate small wins (e.g., staying under budget) to reinforce positivity.

- Cost: Free (affiliate link: Mint Signup).

- Best For: Those wanting a no-cost solution.

- PocketGuard

- Features: “In My Pocket” tool for discretionary spending, savings goals.

- Why It Wins: Prevents overspending, supporting mindful financial choices.

- Mindset Tip: Practice gratitude before spending discretionary funds.

- Cost: Free or $7.99/month for premium (affiliate link: PocketGuard Signup).

- Best For: Avoiding impulse purchases.

- Goodbudget

- Features: Envelope budgeting system, shared budgets for couples.

- Why It Wins: Promotes discipline, aligning with a focused mindset.

- Mindset Tip: Visualize shared financial goals with your partner.

- Cost: Free or $8/month for premium (affiliate link: Goodbudget Signup).

- Best For: Families or couples.

- EveryDollar

- Features: Zero-based budgeting, goal-setting tools, Dave Ramsey’s method.

- Why It Wins: Simplifies budgeting, boosting confidence in financial control.

- Mindset Tip: Reflect on how budgeting supports your long-term vision.

- Cost: Free or $17.99/month for premium (affiliate link: EveryDollar Signup).

- Best For: Fans of structured budgeting.

How to Use Budgeting Apps Effectively

- Set Clear Goals: Define your financial freedom vision (e.g., $10,000 in savings by 2026).

- Review Weekly: Check your app to stay accountable and adjust spending.

- Stay Positive: Use gratitude and visualization to maintain motivation, per Positively Present.

Your Path to Financial Freedom

- Gratitude Journal Template

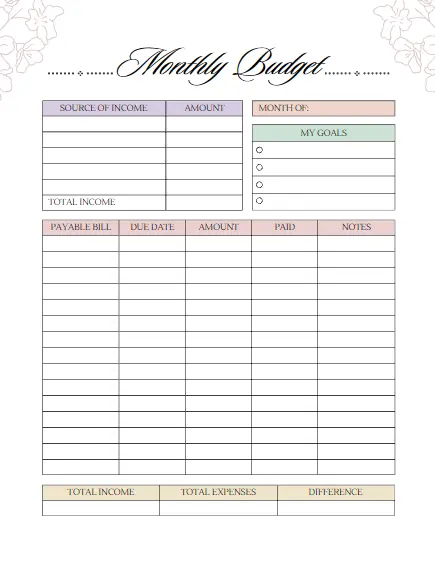

- Monthly Budget Journal

- Vision Board Planner

Conclusion

Changing your money mindset is the key to financial freedom in 2025. By practicing gratitude, visualizing success, and learning from setbacks, you’ll reprogram your subconscious for wealth. Pair these shifts with top budgeting apps like YNAB, Mint, or PocketGuard to take control of your finances. Start today—your future self will thank you! Share your mindset journey in the comments or join our Mindset Reprogramming Community.